We tend to focus on who holds the Bitcoin. Such-and-such famous person has transitioned from bear to bull. Corporations are buying in. Banks are buying in. Governments are buying in.

Imagine banks, governments, and corporations all around the world wanted to buy out the #Bitcoin network, and a lot of the current holders were willing to sell near all time highs set three years prior.

"Imagine" it.

Total Elon Musk is Tweeting to Michael Saylor about switching from USD reserves to BTC reserves. Musk is somewhat of a troll and also Tweeted: "One word: Dogecoin" and Dogecoin subsequently spiked 25%. Yep, people are tools and Musk is a troll. Doesn't mean he won't buy in sooner or later.

Rather than asking who holds Bitcoin we should be asking who doesn't hold it.

- Amazon

- Tesla

- Microsoft

- Apple

- Oracle

- Intel

- AMD

- Netflix

- Cisco

- insert_tech_company_here

There's a good reason why tech companies haven't bought into Bitcoin yet. Setting aside liquidity issues, why would a tech company buy into tech when they can just make their own tech? Bitcoin is open source. Why not just make a corporate coin and sidestep the whole shared economy thing?

They don't yet realize that it's not the tech that makes it valuable, but the network, and you can't fork a network.

Oh, they will.

You can be damn sure that every tech company will have its own coin. To all the conspiracy theorists that are still convinced we are headed toward a one-world-currency, you've already been proven wrong, and you need to get over and accept this new reality. We are clearly headed in the exact opposite direction. They can't all be winners.

Facebooks Libra Diem is being used as an example now, which is obviously ridiculous. Diem isn't going to magically become the world's currency. None of the central banks are on board with that and none of the tech companies are either. You don't even have to add actual crypto to the mix to realize that conspiracy is dead in the water.

Take a look at the tech companies that were associating with Libra before they got absolutely bitch slapped by the central bankers. See any tech companies? Didn't think so. That's because BIG Tech companies have no reason or incentive to buy some other tech company's bullshit when they can just clone the system and roll it out under their own brand and loyal community. That's what this is about: community, and all successful brands have a diehard community.

For the same reason banks don't necessarily want to buy into XRP is the same reason tech companies don't necessarily want to buy into Bitcoin. Why buy Bitcoin when you can just make another token under your control. The tech companies don't "get it" yet.

Diehard Bitcoiners have been spewing a narrative of financial freedom through Bitcoin for over a decade now. The tech companies aren't interested in that. However, they are just starting to realize what Bitcoin actually is: a way for them to store their value directly on the Internet and cutting out these pointless central banker middle men who have been eating their lunch for generations. Now there's a message the bloodsuckers can stand behind.

Because Bitcoin isn't one thing for one group of people. Bitcoin is abundance technology for everyone and it means something different to everyone. It is versatile and is spreading throughout the world like a virus on flat architecture. It creates a playground that puts everyone on more equal footing than they had before, and eliminates much of the corruption of the old legacy system.

Gold 2.0

I know I've made a lot of points in the past about how it's very stupid to compare Bitcoin to Gold 2.0, but there is one aspect that is quite accurate. While a digital asset can't really compete with physical stores of value (and doesn't need to) we likely will see the return of currencies that are backed by it.

USD used to be backed by gold/silver; the currencies of the future will be backed by Bitcoin. I imagine the same pitfalls of such pegs will suffer from the same problems.

https://seekingalpha.com/article/4048750-problem-gold-backed-currencies

It's simply not a good idea to peg a currency to another asset; the network should be able to stand on its own, create its own wealth, and govern itself without the need of some other asset to give it perceived strength. Regardless, I can already see where this is going.

Many corporate entities have been stepping forward and creating stable coins pegged to the USD they have in the bank. Their corporate reserves peg the value of their stable coin to $1. It's a pretty smart thing to do, because issuing a stable-coin generates revenue from exchange fees and the ability to buy low and sell high to maintain the peg. It's basically just free money for any corporation that also controls a centralized exchange or is the custodian of funds like Paypal.

However, it becomes very obvious that all corporations are going to start transitioning to Bitcoin reserves. Therefore many of the coins that they issue will be "pegged" to Bitcoin and/or fiat going forward.

So imagine a corporate coin on an enterprise blockchain that's solely controlled by said corporation. They can "peg" their shitcoin to Bitcoin but at the same time print as much of it as they want, devaluing the coin at a profit to themselves.

Current central banking regulations absolutely ban this kind of behavior currently, but guess what? Central banks are getting weaker and weaker by the year, and just like they were easily able to slap down any digital currency that tried to take root pre-Bitcoin, the abundance technology of the future is going to let corporations get away with crazy shit like this.

Tech companies haven't fully realized yet that Bitcoin is not the savior of the people, but simply another way for them to store their value directly on the Internet and make a metric shit-ton of money using all kinds of new tricks that could have never existed before.

That's why they haven't bought in yet... but we can see that 2021 is likely the year that the floodgates explode on that front. The supply shock is going to be insane and Bitcoin will be trading for over a quarter million dollars a coin in less than 18 months.

Rather than trying to shortcut Bitcoin and go directly to making their own currencies, they are going to realize that this "shortcut" is not viable and will only serve to get them cut down at the knees by central bankers. They've already seen what happened to Diem, and they won't make the same mistake.

Rather Bitcoin will be a vessel for storing massive amounts of value that is transferable anywhere in the world. As the most secure network in the world, Bitcoin does not exist to service the peasants. It exists to serve the richest people in the world. They don't care if fees spike to $100 per transaction. That's peanuts; an amazing deal given high volume.

At the same time this abundance does trickle down to the people. Obviously early adopters like us are going to be filthy rich if we just hold, easier said than done. But that is simply the "old boss same as the new boss" scenario. Many of us will be absolutely corrupted by the wealth that flows into our pockets. We aren't special. We aren't immune to greed. Except me because I'm special.

Bitcoin is going to fall into the background and will be just like the Linux operating system. You all use Linux and you all benefit from it, whether you know it or not. All abundance technology benefits everyone. If you went back 200 years and showed the people what you had, they'd think you were a god. They'd be very confused when you told them you were lower or middle class. Wealth is 100% relative to the people around us.

Conclusion

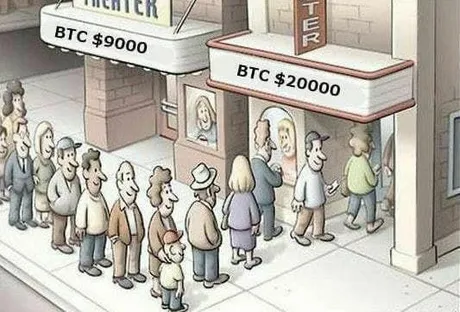

The people who benefit the most from Bitcoin don't even own any yet. I didn't think it was possible for strong-handed institutions to FOMO out of control, but this is a once in a lifetime opportunity that's going to knock even the strongest of hands on their ass.

Michael Saylor, a guy who no one even knows about yet, is going to go down in history as the "genius" that went all in first and fleeced all the corporations that came after. I bet he's even going to trade the market well and sell some after we x10 over the next 12-18 months. Don't be surprised if random and unknown MicroStrategy becomes a trillion dollar company within the next 5 years... but then again at that point many of the corporations won't even be paying attention to USD anymore. Fiat is so last week. Months behind.

Posted Using LeoFinance Beta

Return from Who doesn't hold Bitcoin? to edicted's Web3 Blog