I don't know about you, but I was taught in economics that inflation is absolutely necessary to run a functioning economy. I think about this all the time because now that we have the blockchain this concept is being flipped on its ear. Pretty much every crypto project has an inflation rate set in stone that can not adapt to the market. Many ERC-20 tokens and other ICOs have zero inflation. Are we doomed to fail because of this "flawed" deflationary mechanic?

First of all, we have to assume we've been lied to. Who benefits from inflation? The ones who control it. It's almost embarrassingly obvious that a private institution should not own the world's reserve currency, yet here we are.

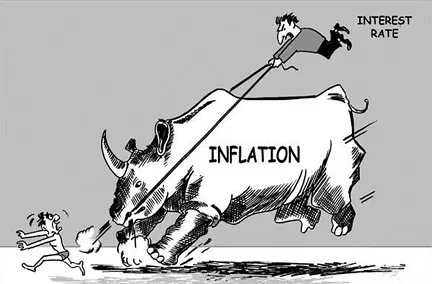

Trillions of dollars can be printed at any moment. Interest rates can change with no guarantees. The only thing that keeps the Fed in check is the fear of losing power or profits. If the economy collapses due to gross corruption everyone loses. It's in their best interests to keep everything running just smooth enough so it can be exploited to the maximum. This creates an interesting push and pull dynamic.

Imagine no inflation

What would happen if the Fed stopped printing money? Well, for starters, the economy would probably collapse because debt can not be paid back. More money is owed than exists, therefore, in order to pay back debt, the Fed must create more debt to pay off the old debt. This never-ending loop of debt-slavery is quite calculating and cleverly hidden from the general public's view.

Ignoring this hole, what happens when inflation stops? Volatility. When a scarce asset can't be inflated people will hoard it as a store of value. Now we have a situation where hoarding creates low liquidity, and low liquidity creates high volatility. Anyone with a lot of USD would be able to manipulate USD and send its value bouncing all over the place just like we see in the cryptosphere.

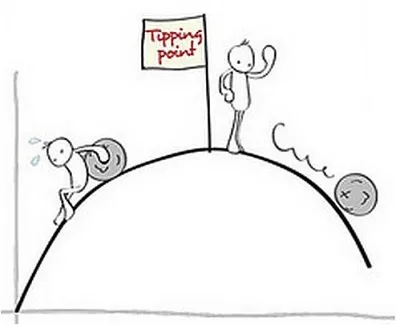

This is why Bitcoin is often criticized for not being sound money. Variable and intelligent inflation/APR can keep the economy extremely stable. This makes USD a very good unit of account. However, the tipping point is approaching. At some point the advantages of crypto will be so heavily tilted that it won't matter if it's stable or not.

There are three main attributes of money that crypto is trying to achieve:

-

Medium of exchange

How easy is the currency to convey value? This is something that gold and other precious metals are very bad at. Heavy and bulky assets need not apply. Crypto is arguably bad at this as well at this point in time. This idea is mimicked in the whole "I want to buy a cup of coffee" argument.

However, every year it gets a little better. More infrastructure combined with simpler interfaces will continue to upgrade the space. This gives investors a lot of wiggle room to speculate because it's only a matter of time before these borderless and open access platforms are actually better mediums of exchange than fiat.

-

Store of value

Here's one we've all heard over and over. Crypto is a store of value. This is a direct and immediate result of the consensus layer dictating inflation in a programmatically transparent way. Because no one is allowed to create inflation without following the rules, this makes nearly every cryptocurrency a superior store of value in comparison to fiat. However, this store of value is exactly what makes it a poor unit of account.

-

Unit of account

If I say things like milk, sugar, car, and house, all of us could likely assign a valid USD value to these items. This is the basis of unit of account. How many people know how many Satoshi it takes to buy that cup of coffee? Very few if any. You'll know Bitcoin has made it when people start cutting out the fiat middle man and start pricing goods directly. The biggest problem here is stability. How can I know how much XYZ is supposed to cost if the value of the underlying asset keeps jumping around like a jackrabbit?

Conclusion

We are rapidly approaching a tipping point where the value of trust far outweighs the stability gained though avenues of efficient centralized regulation. Greed will be its own undoing. Today, crypto is a poor medium of exchange, and an abysmal unit of account. However, smart money has the ability to upgrade itself at the same exponential pace of Moore's Law.

It's only a matter of time before smart money is superior to dumb money in every way. We've been past due for an upgrade to currency for the last hundred years. This financial revolution is going to hit the world like a ton of bricks. In fact, I think we have to assume that this is such a huge upgrade that new emergent properties of money will be established.

For example, what's it called when a currency can create jobs better? What is the "get paid to _____" variable called? What's it called when a currency has better governance solutions? What's the "opt in governance" variable called and how would one measure it? What's the variable called that measures how well the coin takes care of its community? Does it have universal basic income and good healthcare?

These are properties of money that don't even exist yet because fiat is so primitive and outdated.

The cryptosphere has a long way to go, but will surprise us all.

Return from Why Inflation is "Necessary" to edicted's Web3 Blog