Crypto is lawless!

Every market cycle something crazy happens that reminds us of this. The most recent bear market was sparked by corporate greed, comingling funds, and gross overleverage on the user's dime. But it's always going to be something. Expect the pattern to continue. Friction and tensions will always be high as we continue to grind against the legacy KYC system.

Bringing crypto into the fold.

Most people think that this is just an early adopter phase of the tech that will completely vanish in the future. It's the kind of logic that just "sounds right" if one doesn't put more thought into it. I'm here to remind everyone that nothing could be farther from the truth. The entire point of crypto is to continue being as disruptive as possible. The tech itself is the embodiment of the Wild West. That's the entire value proposition.

Think about it.

What does the end of the Wild West phase in crypto signify? Heavy implications are being made that many do not even consider. At the end of the day bringing law into the lawless world of crypto means that imperialism wins. It means that the legacy system has either captured or killed crypto in addition to preventing further uprising. While an argument can be made that this COULD happen, that's not the point. The point is that people who think the Wild West will end aren't saying it COULD happen; they say it SHOULD happen; that all of this is part of the plan and is the natural evolution of things.

Um... no?

The entire point of crypto is to create a subset of sovereignty that exists in the digital world and renders itself immune to conventional warfare. How was the original Wild West ended? Literally by the threat of lethal force and the penalty of death. "Peacemakers" carry guns for a reason. This can't happen within a digital ecosystem, and those that imply it will because "that's just the way things are" end up glossing over a lot of the details of what's going on here.

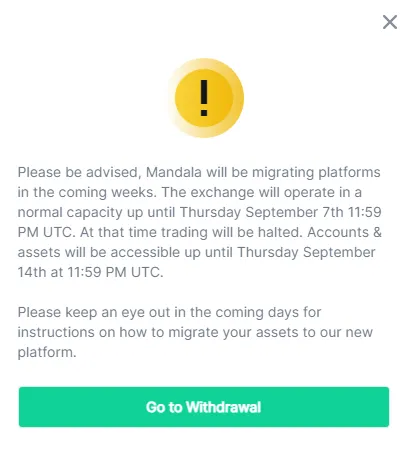

Mandala Exchange update

I was looking for more information on Mandala and ended up finding the original post on the matter: dated May 12th.

Mandalarians,

Binance Cloud recently announced that it will be sunsetting its partner exchange program. While we have enjoyed a successful partnership with Binance Cloud since 2020, it is now time to turn the page to the next chapter of Mandala’s growth.

Ah okay so Binance is so under fire by the regulators that Mandala has been cut off from the liquidity pools. Makes sense. Hopefully the new platform will have okay liquidity and low slippage, but that is yet to be seen.

The 0.2% fee structure will go into effect starting May 15th, 2023 12:00 AM UTC.

They had to double their fees to make up for potential loses in volume. Again makes sense, and 0.2% is extremely competitive in todays market. No complaints there. But the real question I had was about KYC and if the new platform will require it, so I clicked on the KYC link.

MEX requires all users withdrawing over two Bitcoin (2 $BTC) and up to one hundred Bitcoin (100 $BTC) daily from the exchange to complete comprehensive KYC verification in order to transact on the exchange. Users transacting with under 2 BTC per day shall not be required to KYC at this time, pending global regulatory requirements.

"Pending Global Requirements?

lol what does that even mean? Who decides what a "global requirement" is. This is a subject relevant to the main topic of this post because the borderless nature of crypto combined with the inability for countries to agree on things is exactly what allows the Wild West environment to flourish in the first place.

At the end of the day I have to assume that "Global Requirement" just means it's up to their discretion based on how many countries has banned them from operating and if they would make more money under a forced KYC system.

As an aside it always shocks me that the daily allowable limit is measured in a hyper volatile asset like Bitcoin. A 2 BTC limit per day? It's been like that since BTC was $3000 and below. What happens if BTC spikes to a million dollars? Will they really let someone cash out $2M a day? Probably not. It's just odd to use Bitcoin as a unit of account is all.

But back to the Wild West story.

The timelines are off

The actual Wild West lasted decades and was only brought to heel through increased infrastructure and the literal threat of death by the establishment. How does that translate to a digital ecosystem? Well actually it might be largely the same result: the Wild West of crypto could be ended by matured infrastructure.

But again what does that imply?

The legacy Wild West was ended by legacy infrastructure. If we assume that the crypto Wild West will be ended by crypto infrastructure... well that means that crypto is governing itself fully and nation-states have absolutely nothing to do with it. A situation like that would take decades to materialize, just like the original Wild West.

Conclusion

Assuming that the lawlessness of crypto is going to be solved by the current establishment is completely nonsensical, but that's exactly what everyone is doing when they say the Wild West is ending soon and winding down. In truth it hasn't even started yet, much to the chagrin of the regulators.

Crypto has yet to challenge the establishment in any kind of significant way. You'll know it when you see it, as I imagine that multiple wars will be fought over the immense friction created as these two systems continue to grind together, regardless of what the pacifist idealists think. This will not be an entirely bloodless revolution. That's simply not how imperialists operate. We are on their turf and a certain amount of respect and awareness should be allocated accordingly.

At the end of the day crypto will win because people are greedy and the tech creates more collateral value than anything we've seen as a species, to the point of needing to be charted on an exponential/log scale. As an American, it might not work out so well for me personally, but this is a worldwide event; it can't be stopped everywhere all at once. The consensus to contain crypto worldwide will never exist, as nation-states can't even agree on the most basic of rulesets, let alone ones based on a complex monetary system that provides exponential value to the ones who don't ban it.

The entire spirit of crypto is self-sovereignty and the self-governance that goes along with it. Yes, the infrastructure is not good enough to accommodate even basic real-world governance, but are we really going to assume that this will always be the case and that we're just going to allow nation-states to continue to control everything because "that's just the way it is"? I think not.

Return from Wild West "Phase" to edicted's Web3 Blog