https://peakd.com/wleo/@edicted/market-watch-wleo-listed-on-coingecko

Yeah, that'll do it. The weird thing is that this trade was obviously a mistake... This account 0x0000000071e801062eb0544403f66176bba42dc0 sloshed around $11.5k back and forth, paying a 0.3% fee for no practical reason.

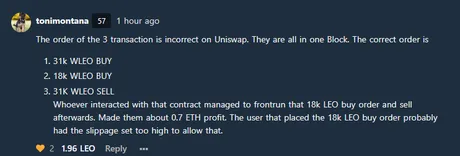

So apparently, this:

https://peakd.com/wleo/@tonimontana/re-edicted-qhe0qe

So apparently this bot saw that someone was buying 18K wLEO and was allowing a ton of slippage. The bot front-ran the buy order (higher gas fee?) With a 31k buy order, and then sold it all in the same block, making a 0.7 ETH profit. That's pretty crazy.

I've actually already blogged about this now that I think about it.

https://peakd.com/ethereum/@edicted/ethereum-flash-loans-what

This is called a flash-loan

Whoever did this didn't even have to own any ETH. He borrowed the ETH and paid it back on the same block, so he was allowed to borrow as much ETH as he wanted using zero collateral. Full-on free money. Wow.

Very good for liquidity providers.

This kind of arbitrage is great for anyone providing liquidity.

I basically farmed $1.50 based on this sequence of 3 transactions.

Let that be a lesson to people who trade outside of "safe" mode on Uniswap.

You shouldn't be willing to pay more than like 2% slippage on the market at this point.

Worth it to buy all LEO on the Hive.Swap market at cost.

So I was looking at some LEO sell orders at 1.1 LEO/Hive.Swap. With the market moving up, it was almost worth it for me to buy and arbitrage. A short while after I considered buying it anyway, someone else did.

It's becoming worth it to buy LEO on the HiveEngine market at cost because gas fees are avoided. Talk about buy wall. It all points to the value of LEO going up in the coming months. Honestly I seems like most everything is going to make gains during the short term as we end the last quarter of the year.

Conclusion

I'd say it's bullish that our market already has bots arbitraging it and whatnot, but I get the feeling that bot is pretty much looking at every market and just making free money with flash-loans. It's not the greatest attention, but it is something.

Return from Yield-Farm Bot Arbitrages wLEO market. to edicted's Web3 Blog