Everyone says to buy the dip...

Bro, with what money am I supposed to do that with?

Those who are constantly all in (like yours truly) find themselves in an awkward position. My advice was to slowly DCA sell any price above $35k. How is that advice aging so far? Pretty damn well if you ask me. Of course it's a shame I can't ever seem to take my own advice.

So Bitcoin dips and I can't buy the dip because I don't have any fiat to buy the dip. Go figure. Have you noticed that though? Everyone says "buy the dip" but no one ever talks about selling enough to actually have the money to buy the dip. It's a pretty flagrant double standard if you ask me.

Obviously the problem with "selling the spike" is that it's impossible to know when Bitcoin has stopped mooning. Sell too early and you'll potentially miss out on a life-changing run. Better to just eat the losses and simply HODL then try to outplay the market that seems to be the master of separating us from our money.

DCA

However, there are safe ways to maintain balanced positioning, selling the upswings and buying the downswings. It's nothing new. Dollar cost averaging is the way to go. Rather than being a min/max all-in gambling maniac you enter and exit the market slowly over time.

I'm just now remembering that I wanted to create a 20-point system for this. Each point would represent 5% of the money one is gambling with (excludes forever-HODL money). When we get the urge to move in or out of the market we do it one point at a time rather than shoving our stake around like maniacs. That's really the way to go. We need to train ourselves to make calm measured decisions over time without trying to reclaim bad-beats or get overly greedy during a winning streak.

Very few people actually play it this way because we get pumped into extreme emotional states during extreme market volatility. This has a tendency to cause us to make quite rash and hasty decisions. Trading this market is somewhat like going to the gym. Everyone should start small and work their way up rather than trying to max out and risk injuring themselves, resulting in a burnout that takes us completely out of the game for a long time.

Many are looking to 2017 for the answer.

After what I've seen, I think it's safe to say that 2021 isn't going to look anything like 2017. In fact I think the real bubble is going to be in Q2 2022 at this point, or at least there's a good chance for that outcome. I need more information from Q1 and Q2 of this year to solidify that position.

Side note

Michael Saylor and Microstrategy recently announced buying $10M more in Bitcoin. Seems... weak and scrambling... if you ask me. Like many of us, the man is all-in and hasn't left himself a buffer in case we drop back down to $20k.

Even though the corporate sharks have theoretically infinite money, that doesn't mean they are just going to throw money away. They are in the ultimate business of making money, and they can see what we all see.

What do they see? A Bitcoin market that's gone x10 in less than 12 months. They see a market that is obviously unstable, so why pump more money into it when they can just wait and buy at a lower price? Things to think about.

I stand alone

I feel like I'm literally the only one bearish on the market right now. Everyone is riding high with their $300k end-of-year predictions. Hell, this is even my prediction. However, in the short term, I still maintain that things are not looking great.

In order to be bullish on Bitcoin, one must be bullish on the market at large. For me, the only way to be bullish on Bitcoin while not being bullish on the stock market is if Bitcoin is trading on the doubling curve (currently $14k). Otherwise a dump in the market will result in an automatic dump in Bitcoin, and as we all know Bitcoin dumps are far more violent than stock market dumps. Thin liquidity is thin.

There's nothing bullish about Q1

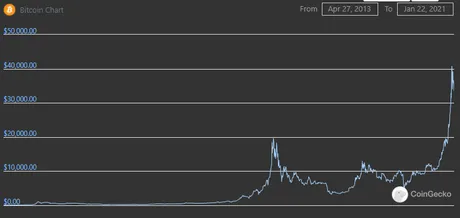

Many people are holding out hope that because 2017 Q1 was bullish that means we'll repeat that and continue being bullish throughout what is potentially a mega-bubble year where Bitcoin will trade 10x higher than the doubling curve. As you all know my favorite metric is this idea that Bitcoin is consistently doubling in value every year. It's a metric that hasn't failed and began in 2013 at $100 at the end of the year Q4.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

From my perspective, it is a HUGE mistake to compare 2021 with 2017 at this point.

We are in completely uncharted territory with everything that's going on right now. From a global pandemic to the Patriot Act 2.0 to the New Normal and a Global Reset. Anything could happen.

This is September 2016 to October 2017. So if we're looking to compare 2021 to 2017 to get a glimpse into these 4-year cycles based on the halving event... what do we see?

I see Bitcoin hitting all time highs in January 2017 and getting instantly rejected back to the doubling curve. Is that what happened in 2021? Uh, no... not even close. We went x3 above the doubling curve and even now we are x2.4 higher than the curve.

The reason why Q1 2017 was bullish for Bitcoin is that it bounced off the super solid support of the doubling curve. We don't have that right now. We are bubbled as hell.

How high did the price get in Q1 2017? $1300... Again, that was only like x1.3 the doubling curve and the price was immediately rejected back to the curve by the end of March to the $1000 line.

So to compare all that to a bull run that went x3 the curve and is even now still x2.4 the curve? Ridiculous. In 2017 Bitcoin was traveling on the curve for the ENTIRE time until we finally broke away in the Q2 summer time. It is no longer a valid comparison. Bitcoin should be trading less than $20k right now, but instead we got a bubble which is basically just free money if I end up being right and turning bearish is the right move. Big if obviously...

So when to capitulate?

So when do I abandon this bearish crusade and admit I was wrong and this mega bubble is even stronger than 2017? The numbers are pretty clear, all we have to do is make a new all time high before the end of Q1... not going to happen.

In fact, I'm going to be surprised if we even break the $35k resistance at this point. I expect $35k to get rejected and we will start trading around $30k until the market finally runs out of steam and dumps to $20k.

I don't understand how so many people can look at this chart and be like yeah, this is fine, why wouldn't it just keep going up like this for the entire year... lol? Like, these things take time.

Timelines

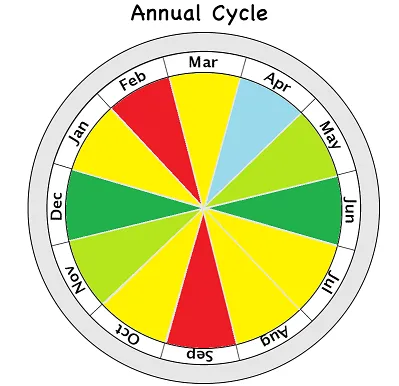

Again, everyone says these 30% retracements are fine... 30% retracements happen all the time right? During a mega-bull run year you get the 30% retracement and then guess what? The price rallies again and hits all time highs all over again. No problem, buy the dip, shut up and enjoy it. Right?!

Wrong.

These timelines are FUCKED. HEALTHY 30% RETRACEMENTS take weeks or months to play out. Look at the charts. They take weeks... or months. I am not wrong. How fast are these current retracements happening? 2 days max. Closer to one day.

These are not the sign of "healthy dips" and/or "consolidation phases". These are the signs of a bubbled market that is insanely volatile and doomed to crash as soon as volume runs dry.

Greed supreme.

But everyone knows that Bitcoin can still hit $300k by the end of the year... so extrapolate that back and it's easy to make a prediction that Q1 is still gonna be great... it's not... it's so not.

Everyone seems to have forgotten that Bitcoin makes all it's gains in violent bursts in short periods of time. You can't extrapolate $300k Q4 Bitcoin backwards and expect it to be a smooth curve upwards. That's not how these things work.

Conclusion

Every single time the market tries to price in these events early, it falls flat on it's face. Every single time. We are in one of those times right now. Corporate sharks went FOMO, bubbled the market, and now it is wholly unstable, and they know it. Of course perhaps Michael Saylor doesn't know it... throwing down another $10M which seems more like a desperate drop in the bucket rather than actual bullishness.

All of the on-chain metrics say we are doing well, all the of the technical analysts say we are going to the moon and still in the bullish channel. They're all wrong. I'm right. Q1 gonna suck. End of story.

So what happens next?

Well if I'm wrong Bitcoin should easily break resistance at $35k and consolidate further... not gonna happen. Gonna bounce off $35k and go lower. February is usually a great month to swing trade an epic dump/pump dead-cat-bounce. Be on the lookout for that. In these situations, March is usually the most disappointing month out of the year... unless you're looking to buy cheap of course.

I'm worried that all this "buy the dip" talk is going to burn people out on buying the real dip, which in my view is obviously $20k-$25k. That's the dip I'm saving up for, and I'm willing to wait a few months to get there. Even if I'm wrong and Q1 is good for Bitcoin, the chance of it being an amazing run is really low, especially by 2017 standards.

Once again, early April is the best time to buy Bitcoin, hands down. The question is will you have any fiat to spend during that time? Or will you be all in like so many others before you? The only way to beat this market is to lower volatility with DCA.

Posted Using LeoFinance Beta

Return from You can't afford to buy the dip unless you're selling. to edicted's Web3 Blog