Sure every crypto could use a big win.

That's the thing about bear markets, eh? Everybody finds themselves in the same sad lifeboat taking on water. Still, better than being the musicians on the Titanic.

Seriously though...

They had over 2 hours to prepare and everyone just sat on their hands instead of preparing for the inevitable. It's exactly the same thing we are seeing in the legacy economy today, except on a much longer timeline. Personally I'd rather be spending my time grabbing anything that floats and tying it together for the makeshift raft. Such is crypto.

Wow! That is ugly.

But it floats, eh?

It's been a wild ride on the high seas!

We got our Wyckoff pattern followed by the classic head & shoulders, and now we wait for the bottom, assuming it hasn't already happened. It somewhat blows my mind to see these valuations and watch everyone scramble and act as though it's all crashing to zero soon. Typical bear market. And yet, we already know that this is exactly how long it takes for the bottom to solidify. One year after peak. We made it, but at the same time the legacy economy looks so terrible it's hard to find any upside in this mess.

As we approach the end of the year, the doubling curve that I often use as a metric for where we should be is around $51k. Yep, I value Bitcoin around x3 the price it is now. Given this metric it's hard to grasp how the price can be this low and still money sits on the sidelines waiting for it to go even lower. With 3 of the top 10 coins by market cap being centralized stable-coins it becomes provably obvious that the money is there just waiting to reenter.

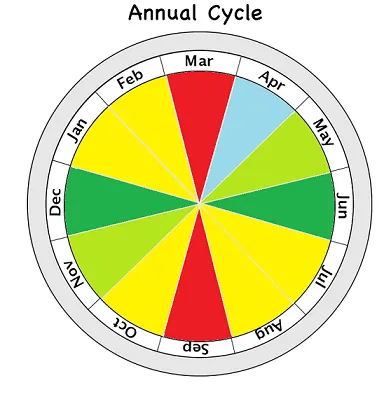

I often claim that February is a bad month for the economy. Gas prices are often at their lowest. Demand is down after Christmas and the back-to-school rush. Everyone is broke and often in a holding pattern. In the same instant, recent price movements in crypto have defied all the classic patterns, and once again we might see February be the start of something interesting. If 2023 rhymes with 2019, that certainly will be the case.

Perspective matters.

February is much different in the USA than it is in say China. The month of February in China is a month of celebration. They take the New Year very seriously over there, which is in February within the East hemisphere.

It will take months for the scared and scarred bulls of crypto to pop out of their holes and reenter the market. People still can't STFU about FTX and Sam Bankman. The chatter has been constant since the collapse. Move on. Sam going to jail isn't going to fix any of your problems. The judicial system moves at a snail's pace. Funny how people forget that as they compare the situation to other moments in history that took literal years to play out. The elite has no incentive to fast track the prosecution of white-collar crime. Think about it. Most are criminals themselves.

What about LEO though?

Yeah, LEO could use a big win. The last big win for LEO was listing wLEO on Ethereum, and it was all downhill from there. From a 2 cent valuation to 80 cents. The hack hit like a ton of bricks, but I'm guessing most have already forgotten about that considering the circumstances. CUB was a huge fail for anyone that invested directly in the token outside the LP. PolyCUB was doomed right from the start from the tokenomics I pointed out before it even launched. The math was simply not sound. It can still function as a testnet though.

But yet people on LEO are still diehard holders. Would be nice to get another win, and we will eventually, but the patience required for such things is the stuff of legend. CUB is making some much needed pivots, and the micro-blogging iterations will go live soon™.

Conclusion

Bear markets aren't fun, but that's how the diamonds are forged. The pressure of these situations is enough to weigh on anyone. It's how we handle the pressure that matters in the long run. Will we make the same mistakes next bull market? Probably! Hopefully not though, eh?

History shows that the bear market has bottomed. Unfortunately there is no history for Bitcoin that shows how it reacts to a recession, as it was created at the bottom of the last recession. Bitcoin was very little known at that time, so we have no metrics to follow this time around. Completely uncharted territory here.

But still, we have to note that the crypto bear market and legacy recession happened pretty much at the same time. Judging by the doubling curve and the x3 needed to get back to it, I have to assume that this market is wildly oversold due to the double whammy. It's hard to imagine another crushing blow coming because we've already spent our year in the gutter and crypto moves faster than any other market. Any kind of decoupling from stocks could send many retreating from the more volatile asset (stonks) and into crypto. At least that's the theory.

So here's to the LEO community and waiting out the winter for another victory. Development is a slow grind, but we'll get there.

Posted Using LeoFinance Beta

Return from LEO could use a big win. to edicted's Web3 Blog