First thing's first

As many have already reported, Sam Bankman-Fried of collapsed exchange FTX is being detained in the Bahamas by order of the United States. I guess now people can stop comparing Ross Ulbricht to SBF as a miscarriage of justice, as if that was ever a logical thing to do in the first place.

I'd like to go on record and say that the mob mentality calling out for his arrest has been nothing short of disappointing and downright disgusting. How does giving a life sentence to some punk make the world a better place? Yeah, it doesn't though. The mob doesn't care. People are monkeys; a forever disappointing state of affairs.

I'd also like to go on record and say that I can't believe he didn't flee the country. He really thought he was going to talk his way out of it by exaggerating autistic tendencies? "The Bitcoin nodes were overloaded?" Really? Wow. But again this just shows how naïve he was and how no one takes responsibility for allowing a degen to hold billions of dollars inside their own little piggy bank. People who lost money in FTX need someone to blame. They sure as hell aren't going to blame themselves. This denial leads to a rage filled need for revenge, which is very much a red flag.

No, the world would not be a better place if you were in charge.

These same people that call out for blood in times like this are the ones who would have done the EXACT SAME THING SBF did. These are facts. People are hypocrites. The loudest voices are the biggest hypocrites. I guarantee it. Just look at all the previous scammers coming out of the woodwork to play the victim card in the wake of the FTX collapse. It's so transparent, yet nobody seems to see it.

But enough about FTX

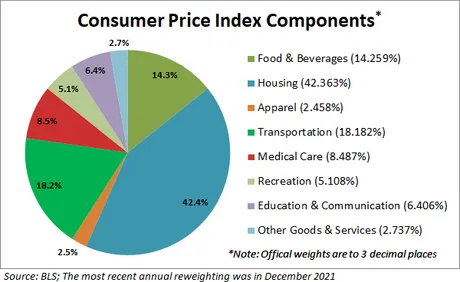

The CPI came in today at 7.1%, which is lower than expected. I knew this would be the case, because if you hadn't noticed, I've been blogging about a deflationary snapback for months. I decided to put my money where my mouth is on this one. Last night I noticed that markets were depressed. I looked up the CPI report and the FOMC meeting and they happened to be on the exact same day... today. lol. What? So I bought some crypto yesterday with the expectation that today would be a bump up. Looks like I was right. I guess I'm getting better at this trading thing.

Also I just gotta say that the ability to turn 600 HBD into almost 2000 Hive was quite shocking. It's so weird to see the price this low. I found out just recently that there is a really nice reservation casino within like 10 minutes of where I live. So weird. Every once and a while I think back to my poker days and tell myself I'm going to hit up the cardroom to supplement my income. I've only been there once and there was only one table going but it was during off hours. Perhaps there are more poker players on the weekend. I really should check it out. I bet I could make more money there than any job available within this tourist town.

Binance fud

Binance FUD has been absolutely unrelenting recently. Truth be told, I don't understand it. Well, I do, but the reason is again rooted in fear, cowardice, and disappointment. FTX collapses and everyone cries wolf. The sky is falling. People need to pull it together and think rationally.

If we just look at how CZ has composed himself during all of this is quite obvious that Binance is doing just fine. He WANTED everyone to pull their money out of exchanges. It was obvious. He was calling out everyone, including Coinbase, one of the most heavily regulated exchanges in the entire world.

Why did he want everyone to pull all their money out of the exchanges? Because Binance is doing just fine and everyone else is getting hammered by this bear market. It's the exact same reason that corporations lower prices below the profitability line and drive out their competition. These are long-term strategies that CZ is employing, unlike literally everyone else in the space.

No matter how we slice it, Binance created a lot of this instability within crypto. Not because Binance did anything wrong, but because that's just how capitalism works. Big fish eat small fish. Welcome to the real world.

With this in mind, Binance heavily incentivized all these now-defunct exchanges to use those shady business practices like yield farming on behalf of the user and whatnot. The smaller exchanges would have never been able to gain a foothold during the bull market without using these tricks because the big boys already have too much of the market share.

This is why I ignored every single new exchange that popped up during the bull market, and I hope this is the lesson that everyone needed for the next time around. However, the next time around may be the rise of decentralized exchanges, so this rule very well may not apply within two years.

I'll admit that I did get a little spooked with the whole Binance situation because people are now talking about lawsuits flying and domains being seized. I still have money on Binance, so I took out another $1000 and sent it to Coinbase. I'll probably have to transfer that to my bank account soon to pay for bills and Christmas and whatnot. At this rate my Binance account will be drained within a couple of months and I won't have to worry about it. I gotta say it feels nice to avoid selling Hive. Perhaps I should chase this feeling more often. Yes, indeed I should.

Analysis

It is highly noteworthy that Bitcoin knocked on the door of $18k today during the 'bullish' moon cycle. I guess I forgot to mention this earlier, but that's another reason I was so confident legging back in yesterday. In any case $18k is important.

If you'll recall, $18k is the exact level I talked about when the FTX implosion began back in early November (why do these volatile bursts always happen in November?). If we can break $18k we can begin to talk about the bottom being in and the end of the bear market. Until then everything is basically just noise. It's nice to see BTC at this level, even if it will struggle and likely ultimately fail to get above there anytime soon.

As stated in a previous post, the real "bear market is finally over" target is trading above $20k. This is a massive psychological level that will flips a lot of the temporary bears bullish again, forcing them to take the loss and buy back into the market.

With the local low still sitting at $15500, this recent bump in price widens the gap even further from the bottom. Trust me, we need as much buffer as we can get at this point. We are 'only' a 13% dip away from hitting the local low again. Traditionally in Bitcoin, this is a nothing amout. This would be a Sunday. But in the current context, 13% is pretty good. That's because we are trading at rock bottom levels, and every 3%-5% dip in price spins up volume to the maximum which prevents further dipping on short timelines. So many people are buying this range, and most of retail is still sitting out due to fear of FTX contagion. It won't be long now before they capitulate at a loss.

If nothing happens to scare retail investors for the next couple months, they'll get bored and leg back in. February and March are going to be big months to lookout for, which is weird because traditionally these months are just a barren landscape of nothing and/or bottoming out. However, if we look back 4 years ago to 2019, this is exactly the time that a new bull market started and ran all the way into the summer (Bakkt institutional FOMO). We traded x3 higher than the doubling curve in summer 2019, which would be something like $200k+ four years later.

Do I think Bitcoin could be trading at $200k in six months? lol... sounds completely absurd. No, I do not believe that could happen within a recession. However, I do believe we could get back to the doubling curve, with the curve acting as resistance. This would put Bitcoin around $50k-$70k in six months, which would obviously be a huge windfall for this depressed market. And also happens to be right around the all time high of the last bull market. Seems like a legit target.

We might not be able to get x3 higher than the doubling curve, but we can definitely get x3 higher than we are now. This bear market has mirrored 2018 in an uncanny way. No reason to think 2019 will be any different at this point. We are finally deleveraged and ready to move back up, assuming nothing crazy happens within a month or two.

Conclusion

I don't trust people that celebrate the prison industrial complex. The establishment has been looking for a sacrificial lamb in crypto for some time, and SBF is the perfect sacrifice. May the death of his freedom usher in the most absurd regulations we have ever seen. Be careful what you wish for!

CPI is doing what we all knew it was going to do: go down. People are being laid off. Warehouses are full of product. Cost of essential goods are choking discretionary spending and forcing prices to come down. None of these things are surprises. People still don't seem to understand that deflation is BAD for the economy. Like, really bad. They see a lower CPI as making up for lost time. That's not how it works. Trust me.

Binance is doing just fine. Don't worry about Binance. But also not your keys not your crypto. I wouldn't hold over 5% of my assets on any single exchange. 0% is ideal but it can also be a pain in the ass to hold nothing on exchanges depending how much trading someone is doing.

At the end of the day CZ is cool as a cucumber while the rest of the space burns to ashes around him. The guy is rooting for the fire. Learn to read the room. Binance isn't going anywhere. Ignore the FUD. Just because they can't prove their liabilities doesn't mean anything. They have $63 billion in assets. They're good. FTX only lost what? $8 billion? Put the numbers in the context they deserve.

Bitcoin is flirting with a breakout to the upside. If we can get back above $20k the bear market will be declared over and the FTX contagion defeated. I think we might have to wait for April before this actually happens, but it's something to look forward to.

Posted Using LeoFinance Beta

Return from What a day what a day. to edicted's Web3 Blog